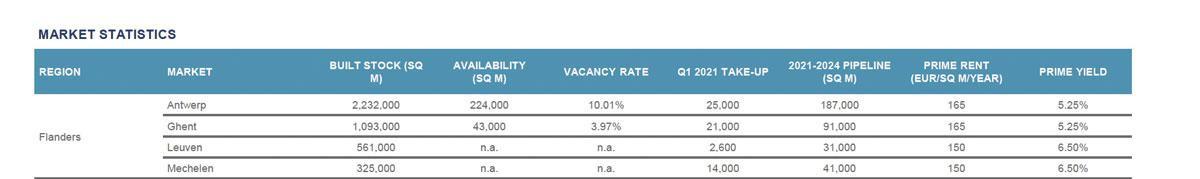

Companies looking for office space have started making visits again but are delaying their decisions. Take up in the first quarter was substantial but artificially inflated due to two transactions by universities. Antwerp remains the driving force behind the Flemish office market with little availability and an increasing prime rent.

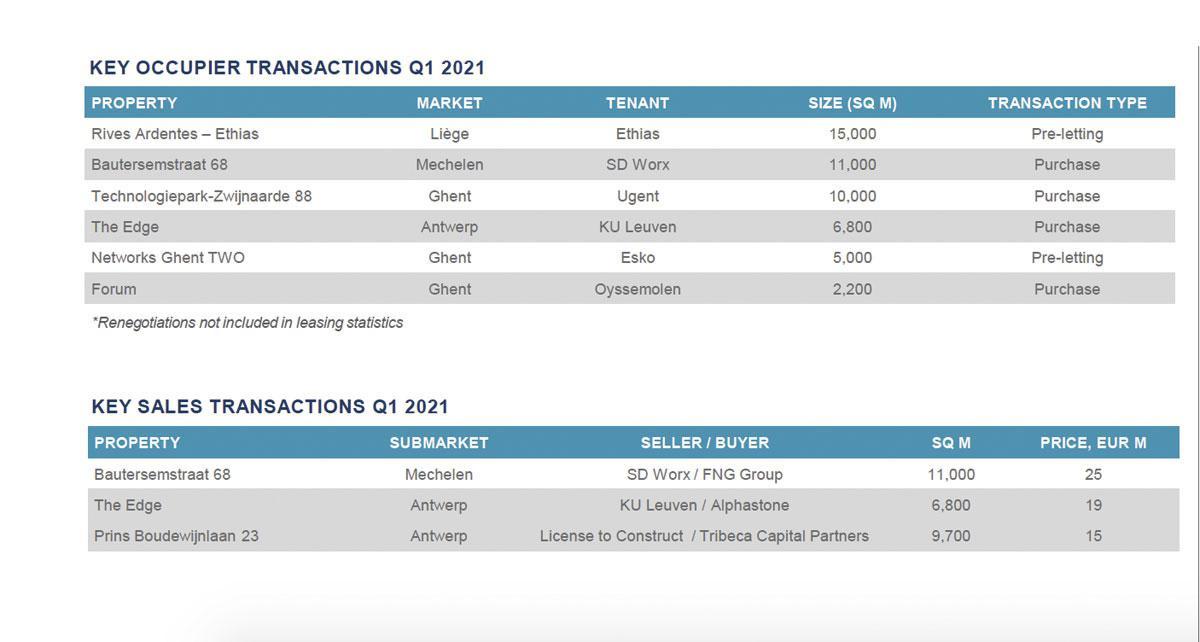

First quarter take-up amounted to more than 62,000 sqm across 70 deals, with high demand compared to historical quarterly levels (first quarter take-up was 26,000 sqm in 2020). Major movers were the higher education sector with both UGent and KU Leuven in the mix (Antwerp, opposite Central Station). The pandemic is set to continue to impact the market negatively, but the speculative pipeline is healthy for the coming years and could entice certain occupiers to move to more efficient premises. Notable projects include The M (Intervest Office &Warehouses, 14,000 sqm) and the renovation and new buildings of Century Center’s offices by Baltisse over several phases (Pelican, Arto and Novo, more than 13,000 sqm in total) in Antwerp, along with Green Court (Baltisse), Upoffiz (Upgrade Estate) and Networks Gent One and Two (Banimmo, 15,000 sqm) in Ghent.

Prime rents remain stable at ? 165/sqm/year in Antwerp joined by Ghent at this level this quarter.

Vacancy level on the increase

At the end of 2020, the vacancy level was 6.75% against 7.8% at the end of 2019. The situation will change somewhat in 2021 as a substantial volume of renovated second hand buildings will come back to the market. The vacancy level will most certainly change in the light of removals to new projects and of a possible reduction in demand for office space in favour of remote working. In Ghent, the vacancy level remains structurally low: 1.9% against 3.5% in 2019. In Leuven, availability has risen slightly to 4% against 3.6% at the end of 2019. The same is true for Mechelen where the level now stands at 5.6% against 4.75% and Hasselt where it has risen from 4.2% to 4.9%.

Investment remains weak

More than 62 million Euros have been invested in regional office markets during the first quarter -a relatively standard start to the year, dominated by own occupancy activity in Flanders, and Antwerp in particular. This includes the purchase by KULeuven of The Edge, a project developed by Alphastone, for ? 19 million. Prime yields remain stable at 5.25% in these specialist markets. What is the outlook for 2021? Prime yields are forecasted to compress to 5.15% by the end of the year given the increased interest in these markets over recent times, coupled with some quality assets arriving on the market. We expect occupier demand to be subdued and prime rents to remain stable.