The six major changes expected in 2021

Although take-up was substantial in the first quarter, the remainder of the story is set to be a little more difficult. Occupants are asking themselves a great deal of questions about which strategy to adopt. There are many new buildings on the market. Sub-letting is also taking off.

The Brussels office market finds itself plunged into uncertainty. Tenants and landlords are asking themselves many questions. Here are the six major concerns at this current time.

1. Why is the record take-up of the first quarter an illusion?

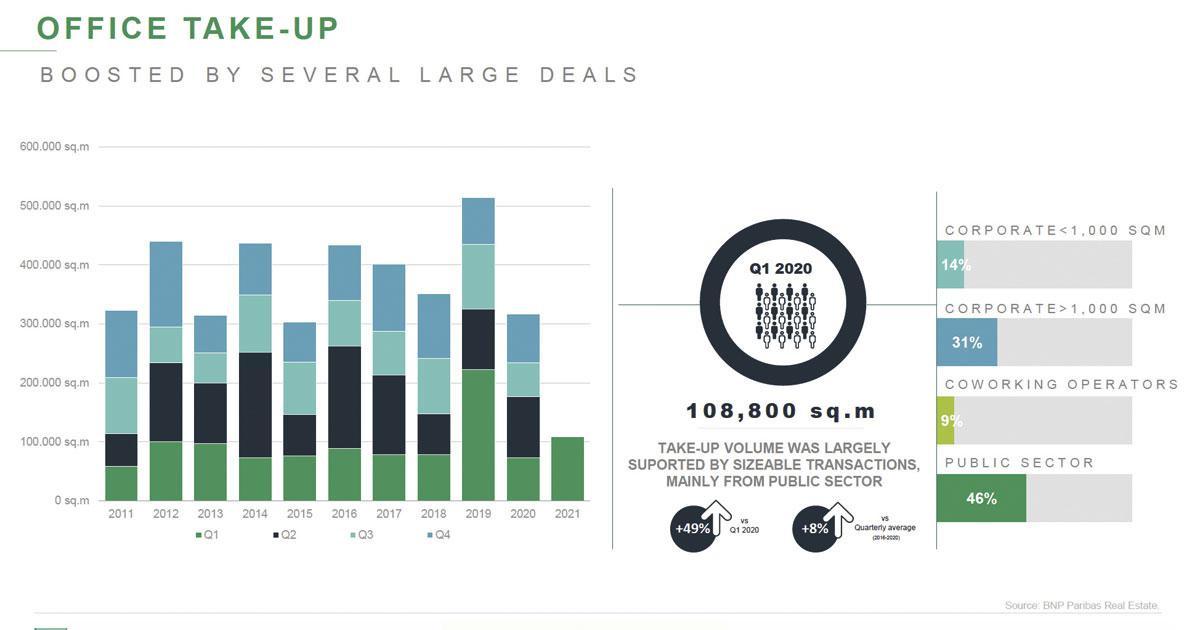

Take-up amounted to 108,800 sqm during the first quarter. An unexpected result. This is in effect th ver, it has to be noted that there were only 56 transactions. And this is, by contrast, the weakest figure for five years. Occupants are mostly playing a waiting game, as they attempt to define their workplace strategy in a post-Covid environment.

There have been only three deals of above 10,000 sqm, of which two involved the European Commission. This body has confirmed the le pre-letting of 13,000 sqm in Copernicus (Alides) and the acquisition of 26,000 sqm in Realex (Atenor), where the future conference centre is to be located. The third deal involves Total. The oil giant has decided to install its new headquarters in the Multi Tower (Immobel and Whitewood), where it will lease 16,500 sqm for 12 years. In the Airport district, SECO is the second occupier to opt for Park 7 (currently under construction). SECO will occupy more than 4,000 sqm along the Boulevard Léopold III, confirming the attractiveness of this district, especially in the best located and most recent and efficient office schemes. Average take-up, which has been around 400,000 sqm over recent years, is set to hover around 300,000 sqm in the future.

2. What will the post-Covid trends be?

“Brussels is still a replacement market”, ventures Pierre-Paul Verelst, Head of Research at real estate broker JLL. “The stock of 13 million square metres is going to reduce but not go into meltdown. There are likely to be more operations of the Total type in the future. In other words moving into grade A offices and reducing the amount of space occupied by half (from 30,000 sqm to 17,000 sqm in the case of Total). In all events the market is going to be more polarized than ever. Numerous buildings will remain empty. Demand will be solely concentrated in buildings which are close to stations, in the city centre and in the European district”.

Jean-Michel Meersseman, Head of Office Agency Brussels and Wallonia at broker CBRE adds: “The market is today divided into two: those which are already suited to the new ways of working, and the others. I am therefore not worried about the future. Take-up is not going to plummet drastically. The objective will be to create attractive workplaces. Only new buildings can respond to this requirement. And there is no vacancy in this type of building”.

Bertrand Cotard, Director Letting & Sales at BNP Paribas Real Estate, believes for his part that one of the major changes will be ‘rental contract flexibility’. This represents a clear evolution within the market. “Certain tenants, for example, want to sign a long term lease for two thirds of the space and the rest for a shorter term, a hybrid model. And our profession is in the process of evolving. We are closer to occupants and we have well understood this”.

3. How much is the sub-letting market going to grow?

“In one building out of two, tenants are asking themselves questions. Landlords are well aware of this. The market is evolving”, Bertrand Cotard is particularly active in this domain at the moment, even if none of the agents is really willing to communicate about the size of this new segment at the moment, nor about those occupants who wish to sub-let part of their space. Sub-letting is nevertheless becoming more and more substantial in Brussels. Engie, Belfius and Allianz are some examples of this. “We have recorded close to 200,000 sqm of grey space on the Brussels office market, far below the 1,000,000 sqm read in some reports and newspapers”, explains Cédric Van Meerbeeck, Head of Research at Cushman & Wakefield. “According to our own calculations, the increase in the working from home trend could lead to space reductions of between 8 and 23% in the coming years. However, the office is here to stay, though in a very different way. As employees may come less often to the office, this will increasingly be seen as a space to collaborate, to foster innovation and corporate culture and to attract and retain talents. As such, collaborative areas along with space dedicated to well-being will increase”.

4. Vacancy of 9.5% at the end of 2023?

Numerous projects are scheduled to be delivered over the coming months. Without speaking of those which have recently been delivered and which have not yet found takers. If you add to this the rationalisation of space by certain occupants due to remote working and the obsolescence of some buildings, the vacancy rate is likely to seriously increase in the future. At the end of the first quarter, the vacancy rate stands at 7.7%, a very slight rise compared to the last quarter of 2020. At the beginning of April, the vacancy level climbed through the symbolic figure of one million square meters of available space. And even more than in the past, tenants are now avoiding buildings of grades B and C. “In the future, everyone is going to concentrate on space located in the prime segment or in station districts”, ventures Bertrand Cotard. “It is in these that there are the most pre-let transactions. Over the past twelve months, vacancy in the CBD declined to a level of 3.7%. By contrast, the vacancy levels in the Dencentralised zone and the Periphery have climbed to 11.2% and 19%.” In the short term, the vacancy rate is set to continue to rise. “By the end of 2023, the vacancy rate could reach 9.5% before experiencing a new decrease as the office market adapts to its new paradigm”, believes Cédric Van Meerbeeck. “By the end of 2025, the vacancy rate should stand at 8%.”

5. Are prime rents going to increase?

No changes in prime rent were recorded in the first quarter: it still stands at ? 320 /sqm/year in the Leopold district. During the course of 2020, several central districts recorded rental growth, including the Louise district which now stands at ? 275/sqm/year. “As this district remains attractive, it could see further increases in the coming months”, is the view of Cédric Van Meerbeeck. “And as competition for the best buildings and best locations remains high, prime rents could rise slightly over the coming years. Tenants are willing to pay higher rents even if they are taking smaller amounts of space”.

In the Decentralised districts, prime rents currently stand at ? 190/sqm/year thanks to different transactions recorded in the ‘Royale Belge’ (namely Puilaetco and Claeys & Engels) which is set to become a new iconic mixed-use development by 2023. They could experience further growth in the coming months. In the Periphery, new developments such as the Park 7 and The Wings will tend to drive rents upwards. They now stand at ? 175 and could reach ? 185/sqm/year by the end of 2022.

6. Will there be any more projects of over 10,000 sqm?

A substantial pipeline is expected for the coming years. In 2021 alone, more than 352,000 sqm will come onto the market, with 175,000 sqm of this on a speculative basis (the largest being Möbius II, the Quatuor and the CBTC in Louvain-la-Neuve). In the longer term, another 200,000 sqm are under construction and still available on the market. The principal speculative projects are located in the North district. “Projects of over 20,000 sqm now under development will be the last for a long time”, estimates Pierre-Paul Verelst. “Projects of 5,000 to 10,000 sqm which are well located will be preferred”.

Vous avez repéré une erreur ou disposez de plus d’infos? Signalez-le ici